Coronavirus Impact on World Economy Deepens

The coronavirus outbreak is having a deep impact on global economies. Stock markets across the world are suffering their worst week since the financial crisis of 2008 due to effects of investment fears related to coronavirus. Simultaneously, many industries are suffering as a result of the outbreak of the highly contagious virus. There are a few winners who are capitalising on the fears surrounding the outbreak, but they are a minority. Forecasters now warn that the economic impact might not be as short-lived as first expected.

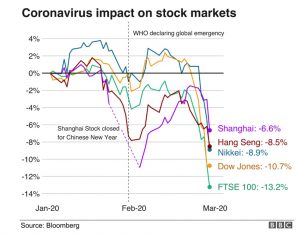

Coronavirus Impact on Global Stock Markets

The main European markets fell sharply today, with London’s FTSE 100 index down over 3%. Germany’s Dax index is down 4.4% and France’s Cac 40 index fell 3.9% today. Yesterday the Dow Jones suffered its largest ever daily points drop. Japan’s Nikkei 225 index fell 3.7%, bringing its fall for the week to more than 9%. China’s Shanghai Composite index also fell 3.7% earlier today. Investors are worried that the coronavirus impact could spark a global recession. Mark Carney governor of the Bank of England told Sky News that the coronavirus outbreak could lead to a downgrade of the UK’s economic growth prospects.

Losing Sectors

Dozens of firms have warned of disruptions to their supply chains and the declines in consumer demand. The automotive sector was affected as far back as late January when exports of items produced in China (the world’s 2nd largest economy) were halted by the start of the virus in the Hubei province. Tesla Inc dropped 17% following announcement that deliveries of Chinese made Model 3 sedans will be delayed. This was followed by announcements of significant effects on US tech giants Apple and Microsoft. US investment bank Goldman Sachs warned yesterday that coronavirus could wipe out any growth in US company profits this year. In the UK, the working hours of 4,000 employees at JCB were slashed as the company attempted to deal with parts shortages from Chinese suppliers. Jaguar Land Rover warned it could run out of car parts at its British factories and said it had been bringing in parts from China to the UK in suitcases. Shares in AB InBev, the world’s largest beer producer, fell 9% following a slow growth forecast for 2020, due in part to the outbreak.

The Chinese account for one third of global luxury goods sales and demand there has fallen sharply. Shares in Jersey-based mining firm Petra Diamonds plunged more than 20%. Burberry and Swatch have both seen their share prices hit in recent weeks and luxury goods group Hermès is due to provide an update to investors on Wednesday. Aston Martin shares fell to a record low as it announced a £104m pre-tax loss and warned of falling demand due to the virus.

Following the spread of the virus outside of China, demand from consumers is also suffering, with a decline numbers travelling and visiting shops, bars and restaurants. The International Air Transport Association (IATA) warned last week that falling passenger demand would cost the airline industry £23.7bn ($29.3bn) in lost revenue this year. Global air travel is expected to fall for the first time in more than a decade.

Few Winners

The price of gold (considered less risky for investors) hit its highest level in seven years recently, however the gains were short-lived following speculations of need for interest rate cuts. Specialist equipment related to viral contagion has seen a surge in demand; including masks, hand sanitisers and disinfectant. Demand for Dettol and Lysol products is surging, as people believe it provides protection against the spread of the disease, although its effectiveness against Covid-19 has not yet been scientifically proven.

Forecast

Economic experts warn that the impact might not be as short-lived as first expected, with a global slow down highly likely as the virus spreads. Economist Stephen Roach told CNBC that the impact will be two quarters duration compared to the one quarter which was observed after the SARS outbreak. Marcus Ashworth at Bloomberg, has said in his Washington Post article that the markets will rationalize and there will only be disruption to one quarter as a recession is being priced in. There is some early-stage pressure on governments to step up fiscal stimulus; as interest rates are already very low most central banks have little room for manouvre in terms of cuts.

SOURCES:

https://news.sky.com/story/coronavirus-could-mean-economic-growth-downgrade-for-uk-mark-carney-warns-11944874

https://www.bbc.co.uk/news/business-51639654

https://www.cnbc.com/2020/02/28/coronavirus-may-hit-chinas-economy-for-2-quarters-stephen-roach-says.html

https://www.theguardian.com/business/2020/feb/23/economic-impact-of-coronavirus-outbreak-deepens

https://www.dailymail.co.uk/news/article-8022065/Hit-Wuhan-flu-diggers-diamonds-James-Bond-victims-coronavirus.html

https://www.telegraph.co.uk/business/2020/02/28/markets-live-latest-news-pound-euro-ftse-100-live-updates/

https://www.bbc.co.uk/news/business-51658361

https://www.dailymail.co.uk/news/article-7971177/Tesla-tumbles-17-electrifying-rally-loses-power.html

https://www.washingtonpost.com/business/markets-are-pricing-in-a-coronavirus-recession/2020/02/28/468c3f9c-5a1a-11ea-8efd-0f904bdd8057_story.html